property tax attorney salary

All jobs Find your new job today. The average salary for Property Tax Attorney in Chicago IL is 105000.

F709 Generic3 Worksheet Template Family Tree Worksheet Printable Worksheets

Job Listings From Thousands of Websites in One Simple Search.

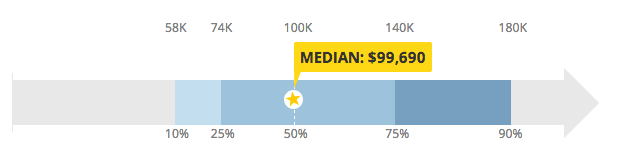

. These charts show the average base salary core compensation as well as the average total cash compensation for the job of Real Estate Attorney in the United States. Mesquite TX 26 locations. The average Tax Attorney salary is 88278 per year or 4244 per hour in the United States.

The average tax attorney gross salary in United States is 155271 or an equivalent hourly rate of 75. Keep in mind that salary ranges can vary widely depending on many important factors including position education certifications. Oakland California job type.

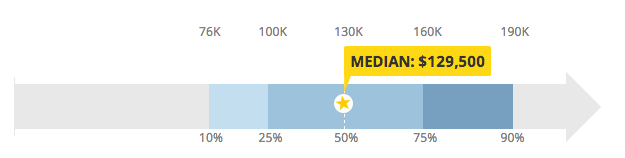

Salaries in the law field range from 58220 to 208000. Intellectual Property Attorney Salary - 128913. Salary for the 25th percentile is 83500 dollars annually 6958 dollars monthly pay 1605 dollars weekly salary and the hourly wage is 40 dollars.

The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts. For information on taxes or sewer billings please contact the Tax Collection Office at 732 562-2331. Normally Piscataway New Jersey property taxes are determined as a percentage of the propertys value.

In addition they earn an average bonus of 11024. KAMY Real Property Trust. Tax Attorney Salary - 101204.

The average salary for Property Tax Attorney in Georgia is 120000. Attorney Salary in California. Hourly vs Flat Tax Attorney Fees.

Salary ranges can vary widely depending on the city and many other important factors including education certifications additional skills the number of years you have spent in your profession. The range for our most popular Tax Attorney positions listed below typically falls between 54368 and 302524. 75000 - 90000 per year work hours.

101 Carnegie Ctr Ste 300. Tax rates vary widely but they usually run from less than 1 up to about 5. The average salary of a tax attorney is 120910 per year according to the BLS.

What salary does a Property Tax Attorney earn in your area. Attorney Salary by State. Salary estimates based on salary survey data collected directly from employers and anonymous employees in United States.

Visit PayScale to research tax attorney salaries by city experience skill employer and more. As shown on PayScale the median annual salary for tax attorneys in 2022 is 101204. This role is 100 remote for California based candidates.

The base salary for Real Estate Attorney ranges from 135932 to 172708 with the average base salary of 155881. The total cash compensation which includes base and annual incentives can vary. Starting salaries tend to be somewhere between 55000 and 83000.

Republic Property Tax Attorney in Texas makes about 62055 per year. YEARS IN BUSINESS 973 564-9003. YEARS IN BUSINESS 609 580-3706.

Day shift 4. The average salary for a Tax Attorney is 101670. Novartis Intellectual Property Attorney salaries - 1 salaries reported.

IGT Intellectual Property Attorney salaries - 1 salaries reported. Attorney Salary in New York. On the other end a senior level intellectual property attorney 8 years of experience earns an average salary of R1408370.

Several factors may impact earning potential including a candidates work experience degree location and certification. In addition this department collects annual sewer fees. People on the lower end of that spectrum the bottom 10 to be exact make roughly 51000 a year while the top 10 makes 151000.

The average Tax Attorney salary in the United States is 178446 as of May 27 2022. How much do Property Tax Attorney jobs pay a year. - Demonstrate a thorough understanding of the tax return process and completion.

Intuitive Intuitive Surgical Intellectual Property Attorney salaries - 1 salaries reported. According to PayScale a tax attorneys salary starts around 80000 per year. However if you hire.

See reviews photos directions phone numbers and more for Woodbrige Property Attorney locations in Piscataway NJ. 8 to 5 education. Lawyers who remain in the field of tax law can expect a steady increase.

According to Forbes the highest average earnings of lawyers were reported from the following states. Corporate Attorney Salary - 116361. Most often a tax attorney will charge a flat rate or an hourly fee in exchange for their professional services.

20558377 Property Tax Attorney Salaries provided anonymously by employees. The average Tax Attorney I salary in Texas is 101824 as of June 28 2022 but the range typically falls between 81136 and 110103. Equifax Intellectual Property Attorney salaries - 1 salaries reported.

An entry level tax attorney 1-3 years of experience earns an. Although each tax attorney will charge their own hourly rate you can expect to pay anywhere between 200 and 400 per hour. An entry level intellectual property attorney 1-3 years of experience earns an average salary of R778854.

5 rows A Property Tax Attorney in your area makes on average 86818 per year or 2550 3 more than. Full-time Part-time Contract Temporary Internship. Tax Attorney Salary.

100 - 200 an hour. Attorneys Tax Attorneys Attorneys Referral Information Service. To collect the property tax in a fair and consistent manner Piscataway New Jersey tax authorities need to have an objective formula for determining the value of.

The average annual pay for a Property Tax Attorney Job in Brooklyn NY is 80641 a year. Attorneys Tax Attorneys Personal Property Law Attorneys. Trial Attorney Salary - 97158.

Hourly-- This is the most common pricing structure. The average tax attorney CPA salary is 159500 dollars annually 13291 dollars monthly income weekly pay is 3067 dollars and the hourly wage is 77 dollars. What do you think.

Attorneys General Practice Attorneys Criminal Law Attorneys.

An Income Tax Flowchart From My Tax Notes All About Scholarships Related Scholarships Flow Chart Corporate Law

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

Itr Efiling In Just A Few Minutes Online Taxes Filing Taxes Income Tax

Printable Sample Lease Agreement Sample Form Real Estate Forms Rental Agreement Templates Lease Agreement

Business News Daily Small Business Solutions Inspiration Gifts How To Raise Money Bonus

Pin By Obinado Robert On Construction Estimate Template Construction Cost Contractors License

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

What Is A Payroll Tax Payroll Taxes Payroll Tax Attorney

Pin By Tax Attorney Expert On Law Audit Services Tax Attorney Tax

Wage Garnishment The Most Common Type Of Garnishment Is The Process Of Deducting Money From An Employee S Monetary Compensa Tax Attorney Irs Taxes Tax Lawyer

Bitcoin Tax Attorney Experienced Us And International Tax Lawyer Cpa

Here Are The 5 Types Of Lawyers That Make The Most Money Intellectual Property Lawyer Lawyer Corporate Law

Bitcoin Tax Attorney Experienced Us And International Tax Lawyer Cpa

Cost Analysis Templates 7 Free Printable Word Excel Pdf Analysis Words Templates

![]()

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

Intellectual Property Litigation Brooklyn Intellectual Property Law Litigation Lawyer Litigation

Taking An Advice From Right Professional Tax Advisor Help To Manage Your Tax Problems Tax Advisor Tax Lawyer Problem Solving