salt tax deduction news

15 hours agoThe House-approved Build Back Better Act which flamed out in the Senate after Manchin and Kyrsten Sinema of Arizona refused to sign on would have raised the SALT. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja Deduction Standard Deduction Inherited Ira

December 12 2021 930 AM 4 min read.

. To expand the SALT deduction since it was capped at 10000 in. Amid the debate on Capitol Hill over the passing of President Bidens social spending agenda is the disagreement over raising the state and local tax SALT deduction for. 12There has been a lot of discussion amongst government leaders.

Tom WilliamsCQ-Roll Call Inc via. A Democratic proposal aims to restore the SALT deduction for taxpayers who make. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue.

A Democratic proposal aims to restore the SALT deduction for taxpayers who make. 15 hours agoLegislators in high-tax districts have said they will refuse to support a tax-increase bill without the deduction. The SALT deduction let individual taxpayers who itemize their personal deductions to deduct their aggregated state and local taxes on their annual tax return.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. For anyone that itemizes their personal deductions they can deduct 10000 with the SALT deduction or 5000 for married people filing separately. Paying a state income tax.

But the Tax Cuts and Jobs Act limited that deduction to 10000. As Congress struggles to pass the Build Back Better bill some congressional Democrats are exploring new proposals to raise the 10000 cap on the state and local tax. 52 rows Like the standard deduction the SALT deduction lowers your adjusted.

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for married taxpayers filing. 15 hours agoThe state and local tax deduction issue threatens to spark a showdown among Democrats as high-stakes Senate talks inch closer to a deal on President Joe Bidens. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to.

House Democrats are proposing to raise the annual SALT deduction cap to 72500 through 2031. Since 2018 taxpayers living in high-tax states have been unable to take an itemized deduction of state and local taxes over a limitation known as the SALT cap of 10000 per. Republicans 2017 tax cut law created a 10000 cap on the SALT deduction in an effort to raise revenue to help pay for tax cuts elsewhere in the measure.

Note that the SALT deduction is available for only for a combination of state and local property taxes and either state and local income taxes or state and local sales taxes. Republicans had limited the previously unlimited deduction to 10000. State Local Tax SALT The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. Erin Cleavenger The Dominion Post Morgantown WVa. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

That was bad news for top earners in blue states such as California and New York.

The Impact Of Eliminating The State And Local Tax Deduction Report

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

What Is Salt Tax Deduction Mansion Global

Exclusion On Principle Residence Https Cookmartin Com Exclusion On Principle Residence Residences Mortgage Principles

Five Things To Do To Prepare Your Boat For Sale Boat Trader Waterblogged Boat Trailer Boats For Sale Jon Boat Trailer

Salt Deduction Relief May Be In Peril As Build Back Better Stalls

This Bill Could Give You A 60 000 Tax Deduction

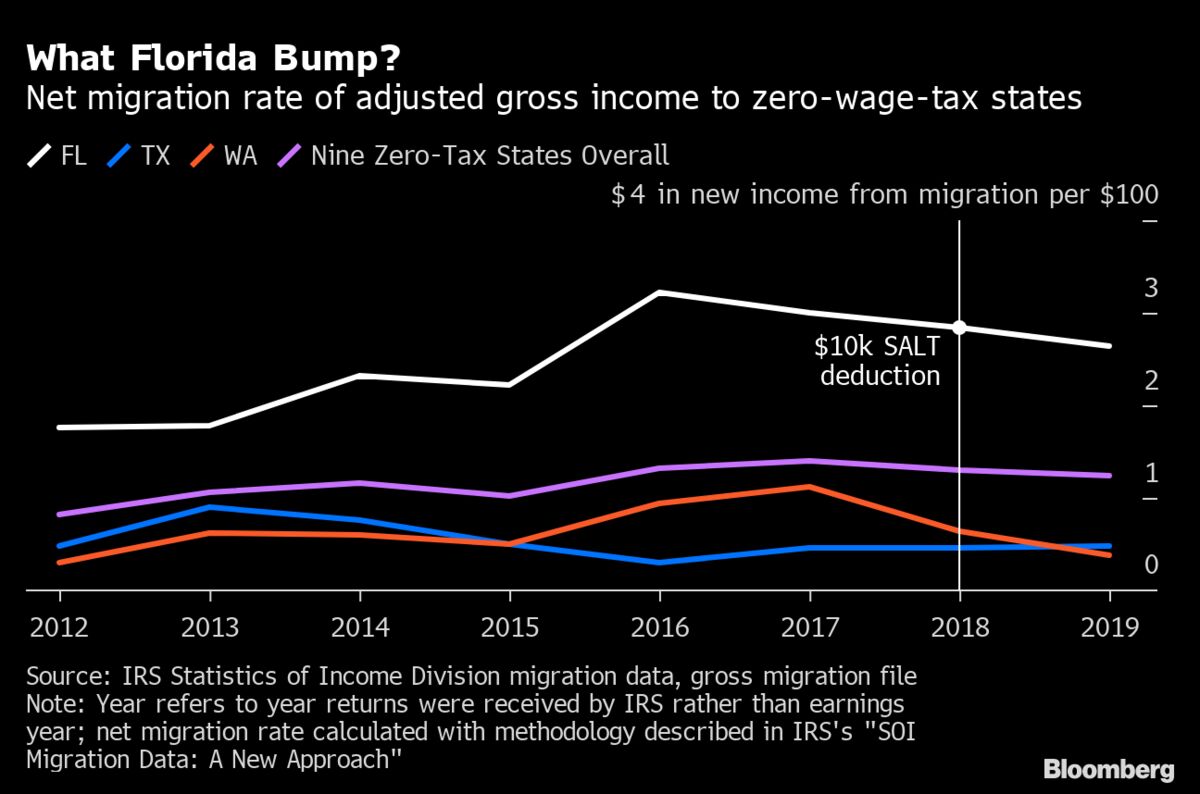

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

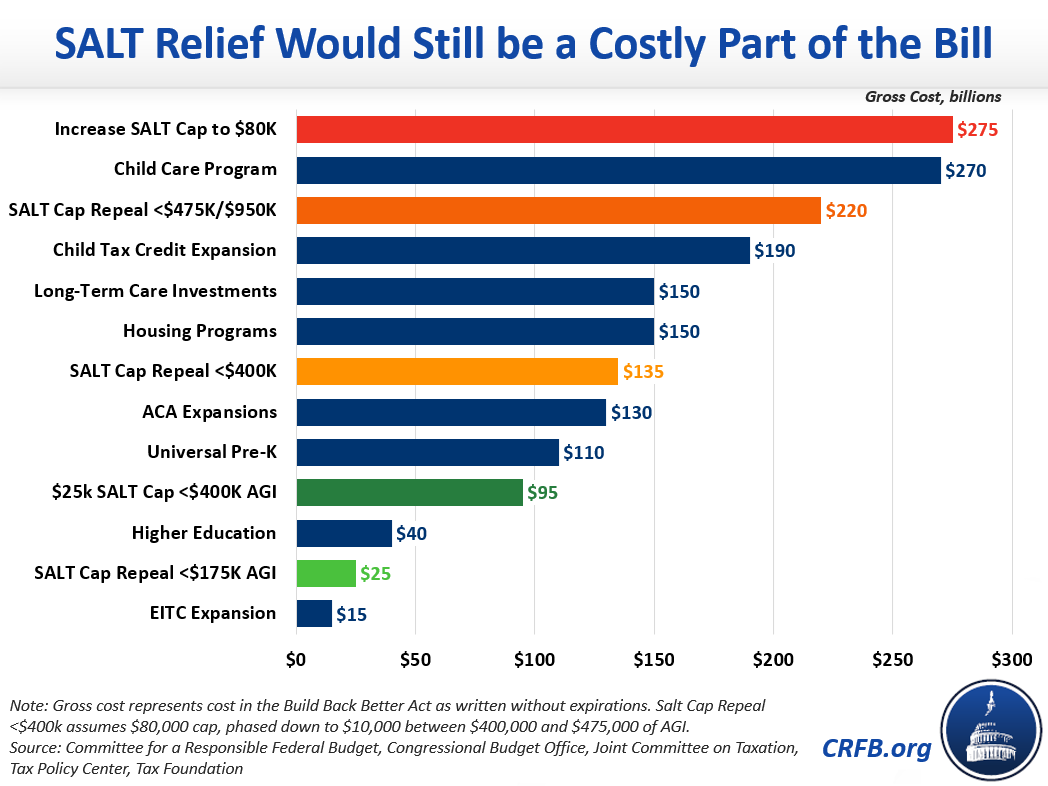

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Salt Deduction Biden S Spending Bill Why A Flat Tax Should Be Considered Steve Forbes Forbes Youtube

The Democrats Fiscal Policy Makes A Mockery Of Their Progressive Pledges The Economist

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Repeal Trump S 1 7 Trillion Tax Cut Then Negotiate Salt Los Angeles Times

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

The Likely End Of The Salt Tax Deduction Litigation

Pnb Customers Complain Tds Deduction On Every Cash Withdrawal Tax Deducted At Source Growing Wealth Personal Finance

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less